The world is getting more advanced as the rapid acceleration in technology and innovation changes the working approach. With the emergence of new technologies, data has also increased. Large volumes of data are generated daily in different business verticals as the data plays a pivotal role in upscaling business success by helping to produce actionable insights. These insights are used for various purposes and help streamline operational activities. Although alone, data cannot be useful as organizations collect and generate data from a variety of platforms. The collected data is typically in raw format, which demands to be formatted, organized, and cleansed to extract valuable information. Businesses need help managing all the colossal data at a time.

Besides, it takes a lot of work to manage, organize, and store lumpsum data, which becomes an overwhelming process. Managing the data for extracting valuable information and insights for different purposes is necessary. Automated data processing services are helpful for organizations to process, store, analyze, and organize information seamlessly and efficiently.

As a matter of fact, efficient and automated data processing services play a crucial role in making sense of data, especially in the finance sector. It becomes evident that data can be filtered and molded to derive certain information or possibilities, which is why the processing of the collected data is significant for business, regardless of nature and size.

The economy is vast, with endless industries and businesses in fierce competition. Firms and industries in the financial industry can significantly benefit from data processing services. These financial institutions include wealth management firms, insurance companies, fintech, banks, and more. As the complexity and volume of data increase, financial institutions often face challenges in managing lump sum data while maintaining the core activities of the business.Manage Financial Data Accurately with Automated Data Processing

Hence, a possible and comprehensive solution for streamlining business operations and improving the firm’s productivity is to hire a reliable data processing company for outsourcing. Hiring a partner will benefit the financial intuition in many ways and offer better data quality to extract useful information. However, let’s understand automated data processing and how it can be lifesaving for financial companies.

Overview of Automated Data Processing?

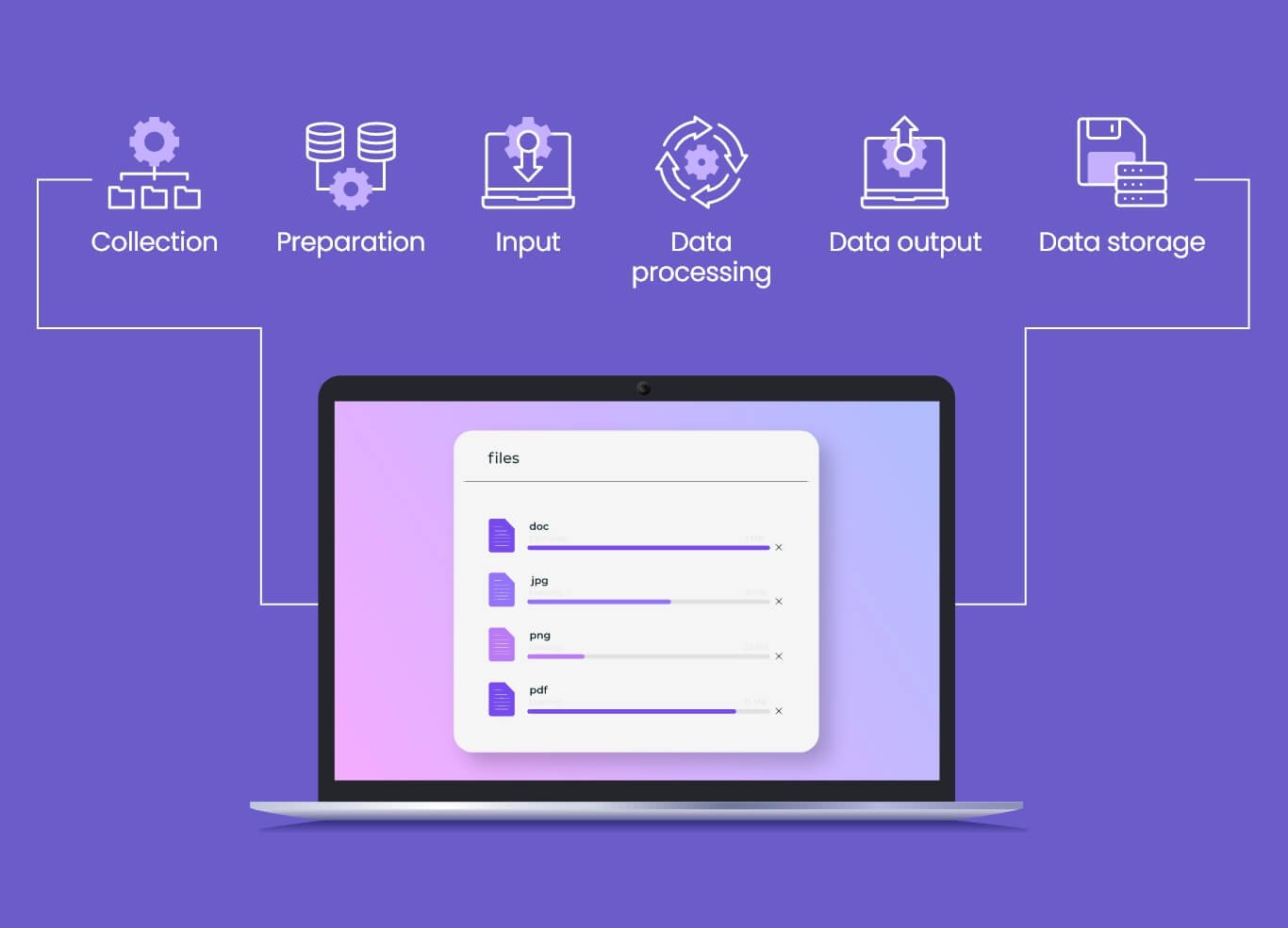

Automated data processing is creating and implementing technology that automatically processes data. This technology is accompanied by computers and other electronic gadgets that gather, store, manipulate, prepare, and distribute data. Automated data processing aims to quickly process lump sum of data with zero human intervention. In other words, ADP is designed to automate and streamline data-related tasks, enhancing quality, bringing efficient results, and managing time while minimizing costly errors. As a matter of fact, this technology is typically used in various industries that deal with multiple datasets, such as financial, healthcare, logistics, and more.

According to a recent survey, 50% of the work can be automated, and nearly 31% of businesses have implemented automation processing for at least one function. It has also been confirmed that about 88% of it improves employees’ lives at the workplace. Since financial institutions generate massive amounts of data from customers, sales, surveys, social media, and more, the amount of information keeps increasing. This is why the implementation of ADP becomes essential for such industries. Other than just minimizing the work and data management, it also offers a variety of advantages, listed below;

- Boost Efficiency

- Ensures Accuracy

- Reduction in Errors

- Offers Valuable Insights

- Enhance Data Security

- Improves Data Integration

- Fosters Agility and Adaptability

With a variety of benefits of ADP and as per survey statistics, it is beneficial to implement automated data processing services to enhance the business quality, easy management of large datasets, and efficient storage of crucial information in designated databases. As a matter of fact, ADP also enhances how financial institutes keep trail of sensitive data. While efficiently managing and storing the essential information without any hassle process of paperwork. Moreover, it facilitates an informed decision-making process and better ROI growth. However, having an in-house team for automated data processing services can be expensive, considering the financial business firm is already hooked on various expenditures. Additionally, this process also requires a sheer amount of expertise and skills. Therefore, outsourcing data processing services by renowned firms that offer automated processes can become a comprehensive solution. Let’s explore some benefits of outsourcing automated data processing.

Key Benefits of Outsourcing Automated Data Processing

As discussed, automated data processing is a technology that processes enormous volumes of data without human intervention. Manual data processing services can take time, while the automated process provides many benefits. Moreover, as technology rises, automated processing services are gradually becoming common as they offer data entry, data cleansing services, analysis, transformation, and more. Outsourcing is advisable as it demands high-end technology, expertise, skill, knowledge, constant overwatch to ensure no errors are made, quality checks, and more. Besides, outsourcing can be beneficial as financial institutes don’t have to set up an entire team and infrastructure to get things done correctly.

Other than that, outsourcing services have become a common concept among business owners as they entail a variety of perks that help organizations save significant business costs, have hands-on quality data, enhance productivity, and focus on the firm’s core competencies. Outsourcing data processing is much more advantageous than setting up an in-house team; the following are the key benefits.

Key Benefits of Outsourcing Automated Data Processing

Cost Saving up to 60%

Better Customer Support

Minized Risk of Errors

Enhanced Data Quality

Offers Flexible and Scalable Solutions

Latest Technology Use

Improved Productivity and Focus

Excellent Data Security

Strategic Data Management

Comprehending Project Timelines

Better Expertise, Skilled and Trained Professionals

The above mentioned benefits can be long. However, it signifies powerful operations to streamline the workflow in the financial institute of the banking sector. The precise model fulfills the need for automated data processing. It also helps in maintaining the firm’s core activities without the risk of data breaches or losses.

Final Remarks

The financial sector is one of the critical sectors of the economy, which is why they need to perform at the utmost efficiency. While outsourcing automated processing services, financial companies get access to economic, scalable, and quality solutions. Partnering with a reliable outsourcing company in India can bring definitive solutions for the firm. Uniquesdata is a leading data processing service provider, offering automated requirements for various economic industries at cost-effective pricing plans.